County Budget and Financial Statements

Welcome to our budget and finance page, where you can find the official documents to learn more about how money and resources are managed in Osceola County, Florida.

Fiscal Year (FY) 2025 Budget Information

For the 15th consecutive year, the county’s general fund millage rate will not increase for FY2025. The overall proposed tax rate also remains the same as last year -- at 8.2308 mills for the general fund, EMS, library, and environmental lands. Although the millage rates did not increase, the Adopted Budget contains the necessary expenditures to maintain the delivery of exceptional services to the citizens and visitors of Osceola County while maintaining a focus on transportation, housing services, and public safety.

During the preparation of the FY25 Budget, the County property valuations reflected an increase over prior year by 11.8% which is a significant percent increase when compared to historical valuations. The Budget represents a continued effort to provide a high level of service to Osceola County residents, business owners, and visitors along with an investment in supporting infrastructure. This includes expanding the existing road network and continued focus on Public Safety. The Adopted Budget is a balancing act between available resources and the demand of mandated and core local government functions, including the above public safety and transportation needs, alongside concentrated efforts to grow and strengthen the County with desired quality of life amenities.

Previous Years Budget Information

Previous Budgets: The County’s budgets for the previous fiscal years, dating back to FY2010. You can see how the County’s revenues and expenditures have changed over time and how the County has responded to different challenges and opportunities.

All Other Budget Reports

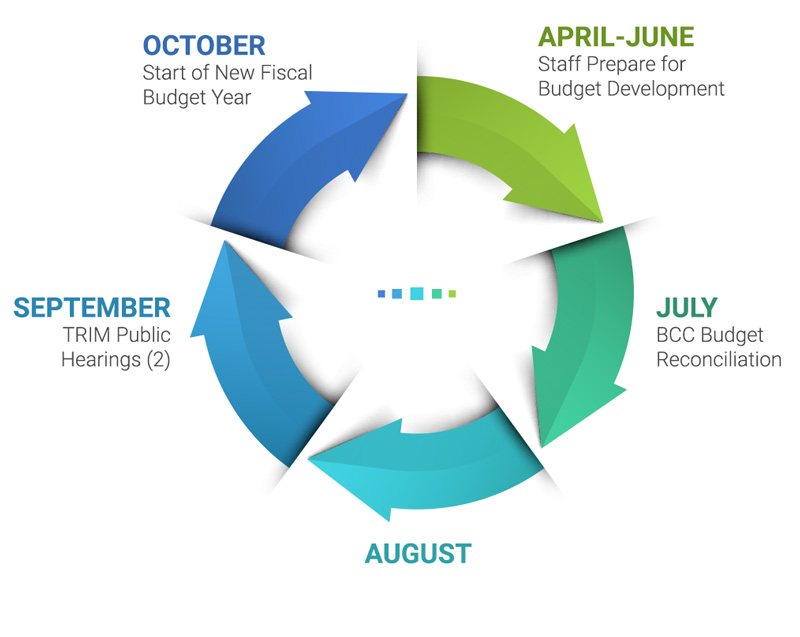

Budget Process

- April - June: Staff prepare for budget development

- July: BCC Budget Reconciliation

- September: TRIM public hearings (2)

- October: Start of new fiscal budget year